Why Choosing a Tough Money Financing Is a Smart Financial Move for Investors

In the developing landscape of realty financial investment, the choice to pursue a difficult money lending can significantly affect a financier's strategy and end results. These financings use unique advantages, such as expedited accessibility to funds and tailored terms that accommodate varied financial investment situations. By prioritizing home value over standard debt metrics, difficult cash fundings enable financiers to act swiftly on rewarding chances that may or else be shed. The implications of this funding alternative prolong past mere access; comprehending the potential mistakes and nuanced advantages is essential for making educated financial investment choices.

Understanding Hard Money Finances

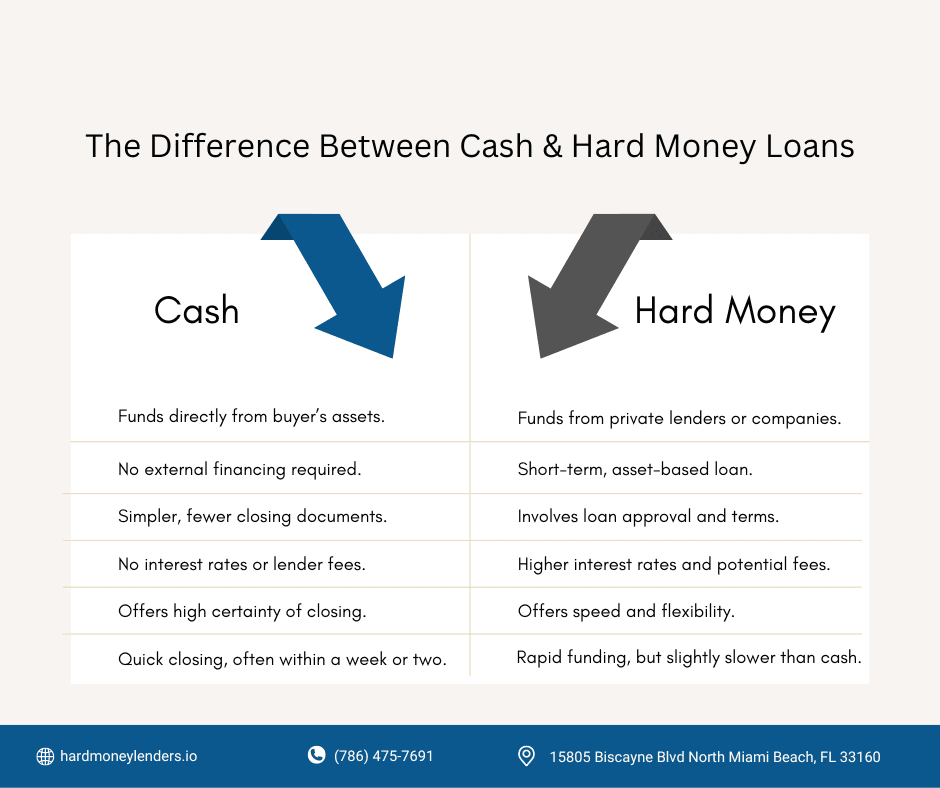

Recognizing tough money fundings is crucial genuine estate investors looking for alternative funding options. These fundings are normally given by personal people or companies as opposed to conventional banks. They act as a feasible remedy for financiers that may not get standard mortgages because of credit history concerns or the need for quick funding.

While these financings provide adaptability and quick access to funds, they usually feature higher rates of interest and shorter payment terms contrasted to standard funding. Investors ought to understand these terms and guarantee they have a clear departure approach, such as selling the building or refinancing, to mitigate the financial dangers connected with tough money fundings. Therefore, a complete understanding of the details of hard money financings is vital for notified decision-making in property financial investments.

Speed and Performance in Funding

In the hectic world of property investing, the capacity to protect financing quickly can make all the difference in taking advantage of lucrative possibilities. Difficult money car loans are specifically designed to offer financiers with quick access to resources, enabling them to act without delay in competitive markets. Unlike traditional loan provider, which usually impose extensive approval procedures and extensive documentation, tough money loan providers concentrate primarily on the worth of the security instead of the consumer's credit history.

This asset-based strategy permits faster underwriting and funding, usually within days instead of weeks. Capitalists can leverage this speed to safeguard homes prior to competitors have a possibility to respond, enhancing their capacity for significant returns (Hard Money Loans In Georgia). Hard money finances usually entail less bureaucratic obstacles, streamlining the entire funding process.

Flexibility in Financing Terms

Flexibility in finance terms is one of the most attractive facets of hard money lendings genuine estate investors. Unlike standard financing choices, which usually come with rigid demands and extensive authorization processes, difficult cash financings can be tailored to satisfy the certain demands of the consumer. This adaptability allows financiers to bargain terms that straighten with their unique monetary methods and task timelines.

For example, the duration of the funding can be readjusted based on the anticipated time for building renovation or resale. Investors might select shorter repayment periods if they prepare to turn a property swiftly or pick longer terms if they call for more time for development. Furthermore, rate of interest and fees can be reviewed and possibly changed, offering a level of personalization not normally discovered in traditional car loans.

This versatility enables capitalists to keep control over their capital while pursuing lucrative opportunities. It likewise enables them to respond swiftly to changing market conditions or unpredicted difficulties, guaranteeing that they can take advantage of investment prospects without being prevented by limiting loan arrangements. Ultimately, the ability to customize lending terms can considerably enhance an investor's total method and success in the affordable property market.

Much Less Rigid Certification Criteria

The application procedure for difficult money finances is typically a lot more structured, needing fewer records and less time for approval. Financiers can often secure funding with a basic property assessment, decreasing the administrative delays that typically come with conventional car loans. This efficiency is specifically valuable for those seeking to take advantage of time-sensitive financial investment opportunities in the hectic realty market.

Additionally, hard money lending institutions appreciate the possibility for quick returns, making them much more going to neglect the economic shortcomings that could invalidate customers from typical financing. As an outcome, investors can seek various jobs without being hindered by rigid qualification obstacles, allowing for higher flexibility in their investment approaches. This availability can ultimately result in even more robust financial investment profiles and the capability to act promptly when possibilities occur.

Leveraging Opportunities for Greater Returns

Harnessing the distinct advantages of difficult cash finances makes it possible for investors to profit from rewarding actual estate possibilities that may occur suddenly. Typical funding methods frequently call for extensive paperwork and long term authorization processes, which can impede a capitalist's ability to act promptly in a competitive market. Difficult money fundings, identified by their expedited approval times and less rigid credentials criteria, encourage capitalists to take these chances before they disappear.

By leveraging tough cash lendings, capitalists can access funds quickly, allowing them to bid on residential or commercial properties that may call for prompt activity, such as repossessions or troubled sales. This agility can considerably enhance the capacity for higher returns, as financiers can purchase underestimated properties, renovate them, and market them for a profit in a fairly brief time frame.

Furthermore, the versatility of difficult cash fundings suggests that financiers can often discuss much better purchase terms, his explanation optimizing their utilize. When implemented tactically, these car loans can bring about considerable earnings, transforming preliminary financial investments into lucrative returns. Therefore, picking a hard cash car loan is not practically getting financing; it has to do with creating the monetary dexterity necessary to grow in a dynamic property landscape.

Conclusion

To conclude, difficult money finances present a calculated financial alternative for financiers seeking quick access to capital and versatile terms. The emphasis on residential or commercial property worth over credit report helps with quicker financing, empowering capitalists to act quickly on financially rewarding chances. Furthermore, the much less strict qualification requirements enable higher engagement in the property market, eventually boosting the capacity for greater returns on investment. Such qualities strengthen hard money financings as an engaging option for informed monetary decision-making.

In the developing landscape of real estate financial investment, the choice to go after a difficult cash finance can significantly affect a capitalist's method and results.Recognizing tough cash financings is important this content for real estate capitalists looking for alternative funding alternatives.Flexibility in finance terms is one of the most enticing elements of difficult cash car loans for genuine estate investors.For numerous genuine estate investors, the less stringent credentials requirements associated with tough cash car loans represent a substantial advantage over traditional funding choices.Harnessing the distinct advantages of tough money lendings makes it possible for financiers to take advantage of on profitable actual estate chances that may arise all of a sudden.